Disaster Declaration for the State of Tennessee

Disaster Declaration for the State of Mississippi FEMA Notice Date: June 19, 2025 On June 19, 2025, the Federal Emergency Management Agency (FEMA) declared that

Stocks – Stocks opened mixed following the S&P 500 hitting a record high for a fourth straight trading session. Investors are anticipating Fed Chairman Powell’s speech from the Jackson Hole Economic Policy Symposium on Thursday for fresh clues on the health of the economy and potential monetary policy changes. Investors are monitoring Hurricane Laura, expected to strengthen to a Category 4, as it moves toward Texas and Louisiana. The two states have issued mandatory evacuation orders in over a dozen coastal cities and counties while issuing voluntary orders in numerous others. U.S. crude edged higher though disruption on pricing from the storms may be mitigated by stockpiles of fuel due to the pandemic’s impact on demand.

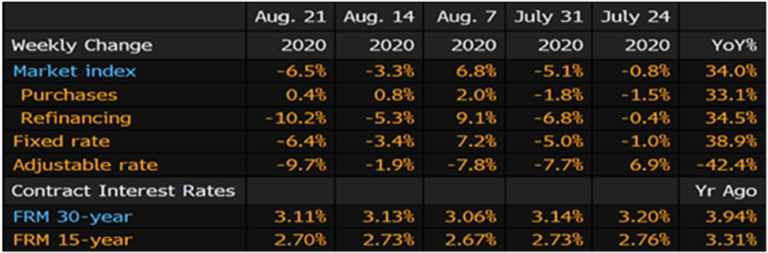

Treasury – Bond pricing continues to fade this morning as treasury yields increase after strong economic data. The 10-year U.S. Treasury is currently yielding 0.716%. MBA applications fell 6.5%

last week, with purchases up 0.4% and refis down 10.2% from the prior week. The average 30-yr fixed rate was 3.11%. U.S. durable goods increased in July by more than double the estimated amount, up 11.2%. Continued surge in automobile demand makes up the majority of the move as factories continue to keep up with backlogged demand.

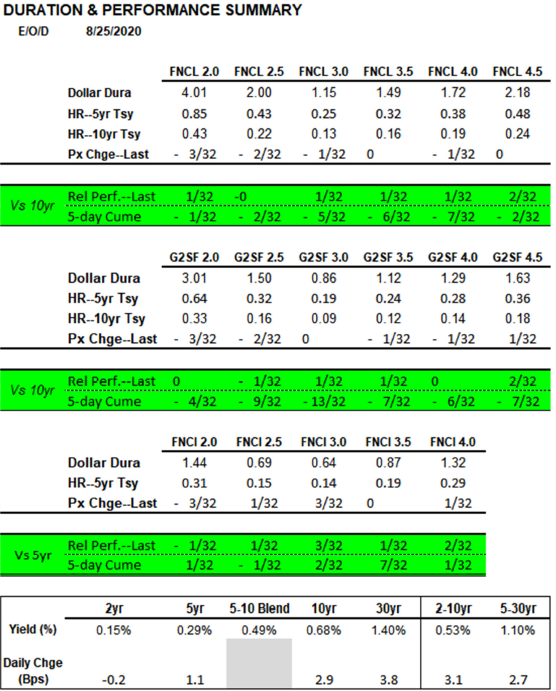

MBS – Fannie 30 Year MBS closed the day yesterday tracking the 10 Year Treasury benchmark. Both high and low coupons closed 1-2 ticks up compared to the benchmark. Ginnies had a similar showing with almost all coupons closing flat to the Treasury as well. Fannie 15 years tracked the 5 Year Treasury sell-off as well. Trading activity picked up a little with $281 billion exchanging, including $27

billion in Specified Pools.

Disaster Declaration for the State of Mississippi FEMA Notice Date: June 19, 2025 On June 19, 2025, the Federal Emergency Management Agency (FEMA) declared that

Disaster Declaration for the State of Mississippi FEMA Notice Date: May 21, 2025 On May 21, 2025, the Federal Emergency Management Agency (FEMA) declared that

Disaster Declaration for the State of Oklahoma FEMA Notice Date: May 21, 2025 On May 21, 2025, the Federal Emergency Management Agency (FEMA) declared that

Get Updates, Specials & More