Disaster Declaration for the State of Texas

Disaster Declaration for the State of Texas FEMA Notice Date: July 6, 2025 On July 6, 2025, the Federal Emergency Management Agency (FEMA) declared that

Stocks – Stocks opened lower as more companies post earnings amid low expectations due to the coronavirus pandemic. Over 75% of S&P 500 companies have now reported second quarter earnings with durable goods makers leading the index lower. Negotiations between Democrats and Republicans are set to continue following an additional meeting Monday between Democratic leaders and White House Officials on the next round of stimulus relief. The Senate is scheduled to leave on break Friday as the debate remains on whether to cut the jobless supplement or provide aid to financially strapped states and localities.

Treasury – Bond pricing is improved, and treasury yields dropped this morning as investors await details on a second stimulus deal. Pressure is mounting as the Senate leaves on break Friday, the same day jobs data is released. The 10-year U.S. Treasury is currently yielding 0.526%. The economy continues to show some rebound as business re-opened in May and June, although many believe it may be short lived as the effects of additional coronavirus cases continue to weigh on the economy. Factory orders rose 6.2% in June versus an expected 5.0% increase. Transportation made up a large piece of the increase.

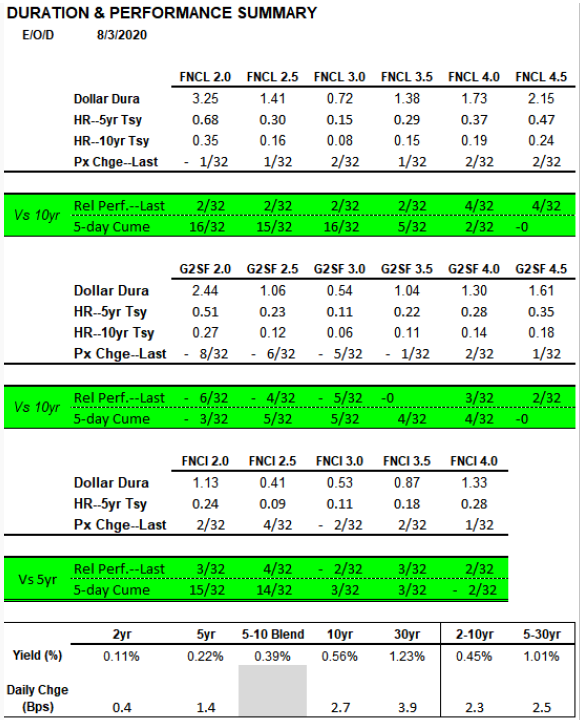

MBS – Fannie 30 Years saw a 2-tick improvement relative to 10 Year Treasury performance by yesterday’s close. Higher Fannie 30 Year coupons including the 4 and 4.5 coupon saw a 4-tick improvement relative to the 10 Year. Lower Ginnie coupons lagged 4-6 ticks behind the benchmark, while higher Ginnies saw a 2-3 gain in performance. Fannie 15 Years, with the exception of the 3 coupon, outperformed the 5 Year Treasury by 2-4 ticks. Trading activity spiked up with $292 billion exchanging, including $28 billion in Specified Pools.

Disaster Declaration for the State of Texas FEMA Notice Date: July 6, 2025 On July 6, 2025, the Federal Emergency Management Agency (FEMA) declared that

Disaster Declaration for the State of Mississippi FEMA Notice Date: June 19, 2025 On June 19, 2025, the Federal Emergency Management Agency (FEMA) declared that

Disaster Declaration for the State of Mississippi FEMA Notice Date: May 21, 2025 On May 21, 2025, the Federal Emergency Management Agency (FEMA) declared that

Get Updates, Specials & More