Disaster Declaration for the State of Texas

Disaster Declaration for the State of Texas FEMA Notice Date: July 6, 2025 On July 6, 2025, the Federal Emergency Management Agency (FEMA) declared that

Stocks – Stocks opened mixed after Chairman Powell reiterated that the Federal Reserve will not preemptively lift interest rates to head off higher inflation. The S&P 500 edged higher, extending Wednesday’s rally that pushed the index to another record close. Abbott Laboratories jumped after receiving emergency-use authorization from the FDA for a 15-minute Covid test. Crude oil hovered near a five-month high as Hurricane Laura crossed over land in the refinery and LNG-rich gulf region.

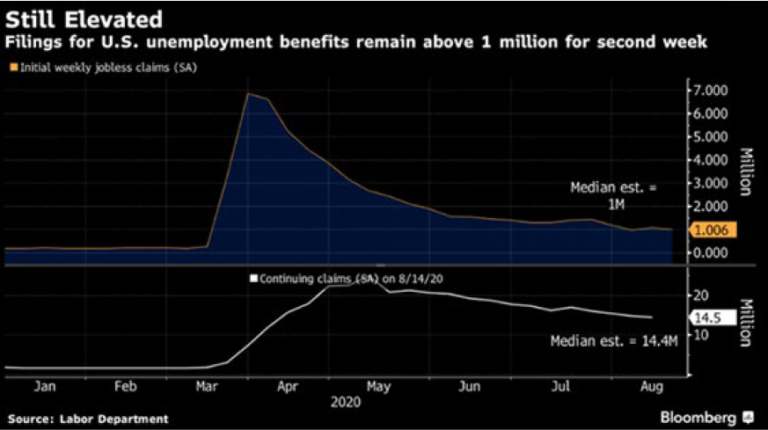

Treasury – Bond pricing is improved and treasury yields fell slightly this morning after Powell announced a new inflation policy to allow inflation to run hotter than normal to support the economy. Applications for unemployment benefits decreased last week following an unexpected increase, but still came in just over 1 million. Ongoing claims also dropped last week and is now hovering at 14.5 million. The Fed will continue to assess employment shortfalls going forward and has revised to seek inflation that averages 2%.

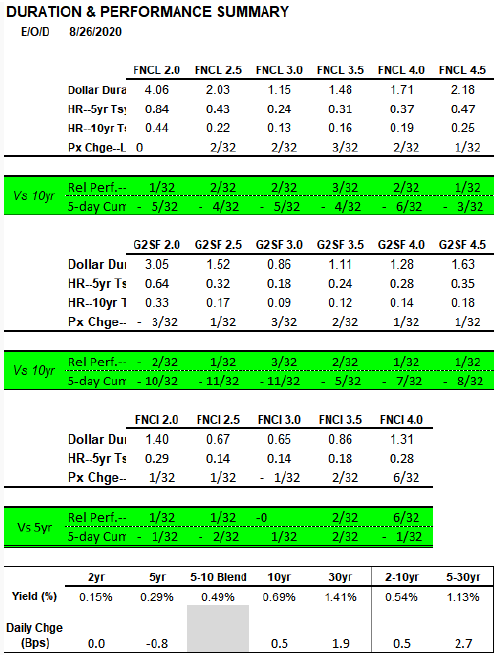

MBS – MBS prices were flat on the lower coupons and slightly rallied on higher coupons by the close of market yesterday. Treasuries saw a very modest gain in yield, if any change at all. Fannie 30 Year MBS outperformed their 10 Year Treasury benchmark by 1-3 ticks. Cumulative 5-day performance however, is still lagging the benchmark by 4-6 ticks for 30 Year Fannies. Ginnie 2’s lagged 2 ticks behind while the rest of the Ginnies outperformed the benchmark by 1-3 ticks. Relative performance of Fannie 15 Years put them 1-2 ticks ahead of the 5 Year Treasury and 6 ticks ahead on FNCI 4’s. Trading activity slowed with $215 billion exchanging, including $22 billion in Specified Pools.

Disaster Declaration for the State of Texas FEMA Notice Date: July 6, 2025 On July 6, 2025, the Federal Emergency Management Agency (FEMA) declared that

Disaster Declaration for the State of Mississippi FEMA Notice Date: June 19, 2025 On June 19, 2025, the Federal Emergency Management Agency (FEMA) declared that

Disaster Declaration for the State of Mississippi FEMA Notice Date: May 21, 2025 On May 21, 2025, the Federal Emergency Management Agency (FEMA) declared that

Get Updates, Specials & More